The financial industry landscape is evolving at an unprecedented pace, and inertia is no longer a viable strategy. Traditional financial institutions stand at a pivotal juncture. The choice is between persisting with legacy systems that erode efficiency and hinder innovation or embracing strategic partnerships that enable modernization fueled by data-driven insights and scalable infrastructure.

Today, incumbent institutions, burdened by monolithic architectures from the early 2000s, are being outpaced by more agile market players. They leverage cutting-edge technology to deliver seamless customer experiences through instant account onboarding, hyper-personalized products, 24/7 mobile accessibility, and other features. Here, the cost of inaction is eroding competitiveness and shrinking margins.

In this article, we explore why outdated legacy systems are crippling financial institutions and how to begin modernizing your technology infrastructure.

The Hidden Costs of Legacy Systems: Key Challenges for Financial Services

As a report from NTT DATA shows, 80% of organizations agree that inadequate or outdated technology is holding back innovation. Outdated platforms aren’t just inefficient. At some point, they become unmanageable. Each patch creates new vulnerabilities, and every workaround piles on technical debt. Meanwhile, the talent needed to maintain these systems is disappearing. Here are some key risks for financial companies:

Poor Customer Experience

Outdated interfaces feel clunky and unintuitive, frustrating users and driving them away. Slow performance and long load times make financial applications inefficient, especially in an industry where speed is critical.

Compliance, Security, and Risk Management Challenges

Legacy systems struggle to keep up with evolving financial regulations, increasing the risk of compliance violations and penalties. Weak security measures leave financial data vulnerable to cyberattacks, while operational inefficiencies heighten the risk of costly system failures.

High Costs and Inefficiency

Maintaining outdated systems drains financial resources due to constant patching, frequent breakdowns, and the need for specialized support. Manual processes add unnecessary overhead, while poor documentation and reliance on tribal knowledge slow down operations.

Integration and Scalability Issues

Legacy systems are difficult to integrate with modern APIs, third-party services, or emerging financial technologies. As transaction volumes grow, outdated infrastructure struggles to keep up, leading to bottlenecks and downtime.

Developer Roadblocks

Poor documentation and outdated programming languages make legacy systems difficult to maintain and update. The shortage of developers skilled in older technologies drives up costs and increases reliance on a shrinking talent pool.

Read Also Client Through the Looking-Glass, or How Not to Devalue a Project by the Lack of Documentation

Examples of Financial Legacy Systems and How Their Transformation Helps

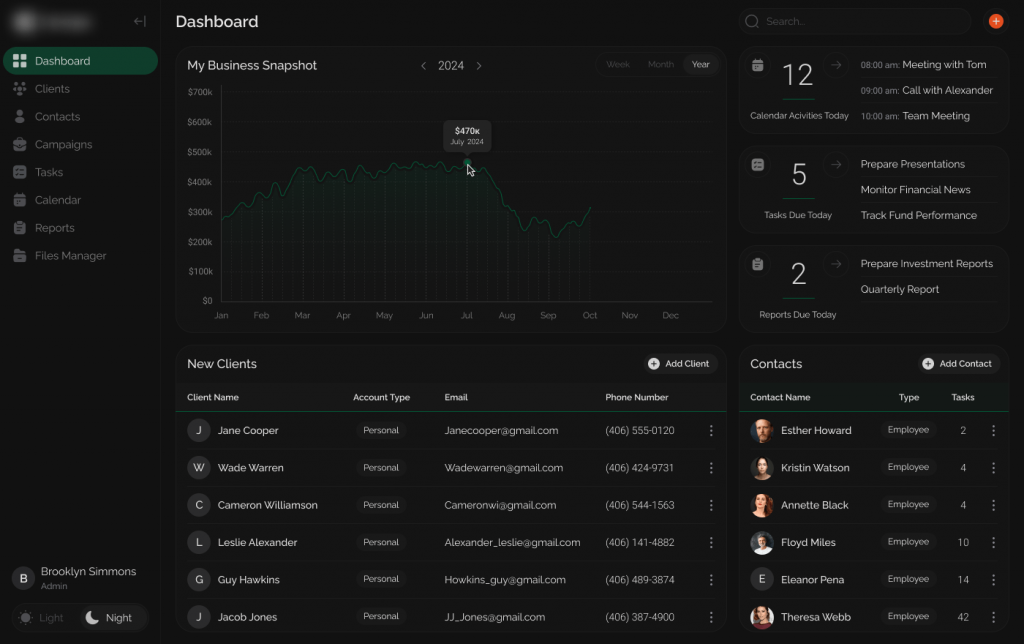

Running a financial business with a small, dedicated team means every minute counts. Yet, clunky systems and outdated workflows often slow down decision-making and limit your firm’s growth potential. If you’re an owner, partner, or senior executive overseeing technology and operations, you’ve likely faced these inefficiencies firsthand. Here’s how modern solutions can streamline your core financial processes, helping your business scale without adding complexity.

The Challenge:

- Navigating client data takes too long, for example, users need 5+ clicks for basic actions;

- No unified client view across services, making cross-selling difficult;

- Manual data entry and prone to errors, leading to wasted time and resources;

- Lack of integration with other business tools complicates workflows and processes;

- Limited analytics doesn’t provide advanced insights needed to understand customer behavior and preferences, limiting the company’s ability to offer personalized services.

The Solution:

- AI-powered smart search cuts client lookup time by 50%+;

- Drag-and-drop workflow builder allows your team to personalize views with zero coding skills required;

- 360° client profiles aggregate all interactions, shifting user effort from searching for data to leveraging insights for strategic decisions;

- A unified platform where all customer data can be accessed and managed efficiently;

- Embedded analytics tools to track client investment behavior, spending patterns, and risk profiles, enabling data-driven personalization and proactive advisory services.

Impact: Faster client interactions, fewer errors, and a more personalized experience that drives retention.

The Challenge:

- No real-time data access limits fast decision-making;

- Reports are disconnected from daily workflows, making insights harder to act on.

The Solution:

- Customizable dashboards with real-time data access and multi-dimensional filters to uncover hidden trends;

- Automated report generation tools triggered by different scenarios, such as specific market conditions or key events;

- Embedded predictive analytics using economic and mathematical functions, integrated with Matlab and R, eliminating the need for external tools.

Impact: Make data-driven decisions instantly, with insights always at your fingertips, turning static charts into dynamic, decision-ready visuals.

The Challenge:

- Performance data is batch-processed, causing delays;

- Portfolio rebalancing requires manual intervention;

- Limited scenario analysis restricts risk planning.

The Solution:

- Real-time position monitoring with automated risk alerts;

- AI-driven portfolio optimization for smarter rebalancing;

- What-if simulation tools to stress-test different market scenarios;

- Built-in function editor ensures adaptability without costly redevelopment.

Impact: Respond to market changes faster, optimize portfolios with less effort, and maintain flexibility as markets evolve.

The Challenge:

- Documents are scattered across multiple systems (SharePoint, network drives, email);

- No enterprise-wide search function, making retrieval slow;

- Manual tagging creates inconsistency and compliance risks.

The Solution:

- A unified financial document hub with intelligent categorization;

- AI-powered auto-tagging for instant retrieval;

- Automated verification for audit-ready recordkeeping;

- Smart retention policies ensuring compliance with financial regulations;

- AWS cloud infrastructure eliminates performance bottlenecks, ensuring scalability as data and compliance needs grow.

Impact: Reduce administrative burden, ensure secure, organized document access, and enable seamless collaboration across teams.

Your time is valuable, and your systems should support your business, not slow it down. By implementing modern financial solutions tailored for your specific company, you can eliminate inefficiencies, make better decisions, and create a seamless experience for clients and staff alike.

Use Case Example. Modernizing a Desktop App for Advanced Financial Data Management and Visualization

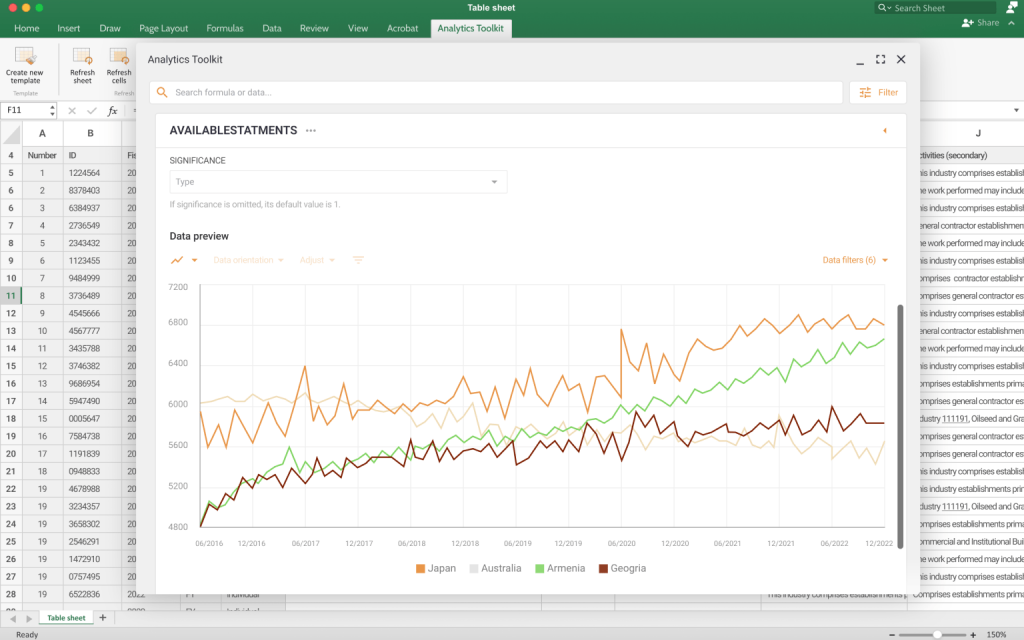

To see how modernizing a financial system looks in real-life projects, let’s consider the Economic and Investment Research tool use case.

Business Challenge

A financial services company relied on a legacy desktop application for economic and investment research. This application was slow, difficult to enhance with new features, and struggled with large volumes of data. The goal was to create a modern, scalable solution capable of efficiently processing vast amounts of data and complex functions. Additionally, the new system needed to improve work in large teams.

Modernization Approach

At XB Software, we don’t just upgrade systems. We engineer and implement productivity leaps. We combine deep UX/UI expertise with battle-tested technologies like Node.js, React.js, .NET, ElasticSearch, and other technologies. It helps us transform clunky workflows into agile platforms where data drives decisions, collaboration thrives, and inefficiency dies.

Our team developed a robust web-based platform designed to handle extensive datasets and complex analytical functions. The modernized system efficiently processes vast amounts of data. At the time of development, the plan was to load 4 million economic indicators into the app. Now, the app handles up to 10 million. Also, it supports complex functions like seasonal adjustments and forecasting, enabling more accurate and timely financial analyses. The platform supports collaborative work, allowing users to share documents with varying permissions and provide previews for external stakeholders.

Excel Add-In Integration

While the primary focus was on the web application, an Excel add-in was also developed to cater to users requiring additional capabilities beyond the main application.

The Excel tool ensures data synchronization with the database. If an indicator is updated, new time points are reflected in Excel as well. Users can also export charts and tables to Excel for use in reports.

Read Also How to Build an Excel Add-in With React

Results

- Scalable Web Platform. The new system efficiently handles a growing database of economic indicators, supporting advanced analytical functions;

- Enhanced Collaboration. Users can share documents with varying permissions and provide previews for external stakeholders;

- Excel Integration. The Excel add-in provides synchronized data access and export capabilities, complementing the web application.

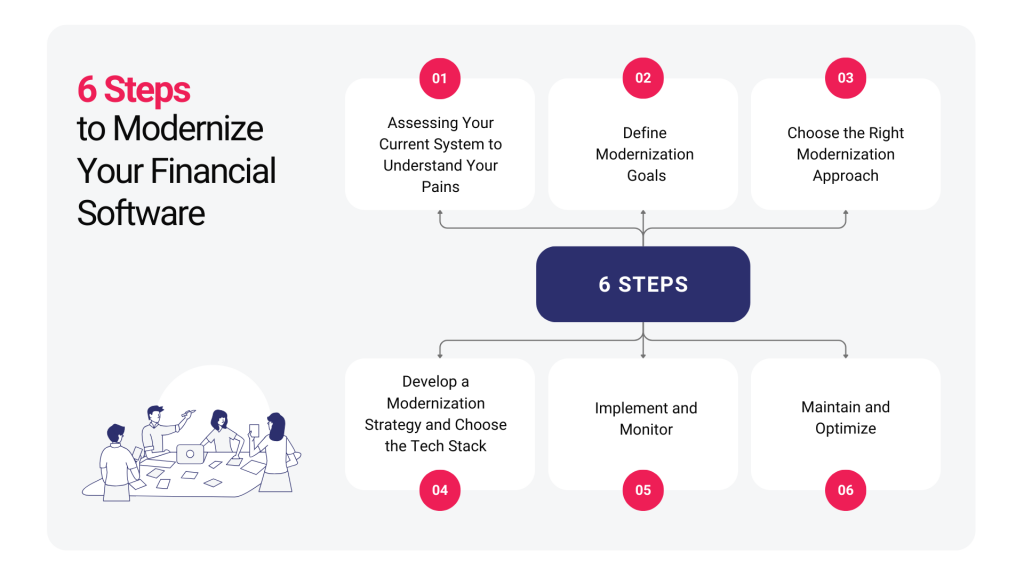

How to Modernize Your Financial Software in 6 Steps

The first step in any financial modernization journey is a thorough evaluation of the existing system. Without a clear understanding of current inefficiencies, risks, and limitations, it’s hard to make informed decisions about modernization. This assessment helps pinpoint critical weaknesses and sets the foundation for a successful upgrade.

Key areas to evaluate include:

- Technology Stack and Architecture. Many financial companies still rely on monolithic applications or outdated technologies that limit scalability and integration with modern solutions. Analyzing whether the current stack supports cloud adoption, API-driven architecture, and modular development is crucial;

- Performance and Reliability Issues. Frequent downtimes, slow transaction processing, and system bottlenecks are common pain points. Monitoring system logs and performance metrics can help uncover inefficiencies that impact user experience and operational efficiency;

- Security and Compliance Risks. With evolving financial regulations, ensuring compliance is a top priority. It’s vital to assess vulnerabilities, data encryption practices, access controls, and incident response readiness;

- Integration Challenges. Legacy systems often struggle to integrate with modern payment gateways, fraud detection tools, or AI-driven analytics platforms;

- User Experience and Customer Satisfaction. A poor digital experience can drive customers to competitors. Reviewing user feedback, tracking session analytics, and assessing mobile responsiveness can highlight usability issues that need to be addressed.

Various assessment methods help us detect modernization issues:

- Codebase analysis reviews structure, readability, and maintainability, identifying outdated frameworks, security risks, and performance bottlenecks. It also reveals hard-coded dependencies and modularity issues;

- Infrastructure and deployment review assesses hosting environments (on-premises, cloud, hybrid) and identifies opportunities for cloud migration or CI/CD automation;

- API and integration testing maps third-party connections, payment gateways, and regulatory platforms while evaluating API documentation quality;

- User experience and performance testing involves load tests, performance monitoring, and user flow analysis to pinpoint possible issues;

- Stakeholder interviews with IT teams, product owners, and compliance officers uncover internal challenges, while customer support insights highlight common user complaints.

After assessing the existing system, the next step in software modernization is defining clear, measurable goals. Without well-defined objectives, modernization efforts can become unfocused, leading to delays, unnecessary expenses, or solutions that fail to deliver business value. Every financial company has unique challenges, but modernization goals generally fall into these key categories:

- Improving Scalability and Performance. Upgrading infrastructure to handle increasing transaction volumes. Enhancing system response times to reduce latency in financial transactions;

- Optimizing Operational Efficiency. Automating manual processes such as risk assessment, KYC (Know Your Customer) verification, and reporting. Integrating AI-driven analytics for fraud detection and personalized customer experiences;

- Enabling Seamless Integration with Modern Technologies. Ensuring compatibility with modern APIs and third-party financial services. Adopting cloud-native solutions for improved flexibility and disaster recovery;

- Enhancing Security and Compliance. Ensuring adherence to regulations and strengthening data encryption, fraud detection, and identity verification processes. Implementing role-based access control and multi-factor authentication for secure user management.

- Enhancing Customer Experience. Upgrading user interfaces for more intuitive and mobile-friendly banking experiences. Implementing AI-powered chatbots and virtual assistants for 24/7 customer support;

Read Also AI at Your Service. How to Build an AI Assistant in 9 Steps (feat. DHTMLX ChatBot)

To ensure modernization delivers real value, we work with clients to set measurable Key Performance Indicators (KPIs). These may include:

- System Uptime: Achieving 99.99% availability post-modernization;

- Transaction Speed: Reducing processing time from seconds to milliseconds;

- Compliance Metrics: Meeting 100% regulatory requirements;

- Customer Satisfaction Scores (CSAT): Improving Net Promoter Score (NPS) and reducing churn rates;

- Operational Efficiency Gains: Reducing manual processing time by 50% or more.

By defining these goals early, we create a strategic modernization roadmap that aligns with business priorities, ensuring that every change made has a tangible impact.

Based on our extensive experience in modernizing applications, we typically work with the following approaches.

Complete System Redesign. Some applications require a total overhaul, meaning both frontend and backend need to be rewritten. This is common when dealing with legacy systems that lack documentation or are built with outdated frameworks. Techniques like reverse engineering, business logic extraction, and user interface (UI) redesign play a vital role in such projects.

User Interface and Experience Enhancements. When a system’s backend remains functional but the user experience is outdated, we focus on improving UI/UX. This may involve replacing clunky interfaces with ReactJS dashboards. We can implement features like smart search leveraging existing APIs that helps end users cut query times by 50%. Additionally, intuitive drag-and-drop workflows help reduce manual errors. We focus on restructuring navigation, and integrating new UI components to enhance usability while ensuring backward compatibility with the existing system.

Database Migration and Optimization. Many legacy applications store large amounts of critical business data stored in siloed, inefficient databases, which needs to be preserved during modernization. We employ structured data migration strategies, automated data mapping, and validation techniques to prevent data loss or corruption while optimizing database performance. AWS cloud infrastructure we often rely on eliminates bottlenecks, allowing multi-department teams to securely access, analyze, and share data, breaking silos that delay decisions.

Example: Custom CRM for Financial Services

Incremental App Expansion and Feature Development. When businesses need to add new functionality while keeping their existing systems operational, we take a phased approach. This includes analyzing the existing architecture, upgrading dependencies, improving security, and gradually integrating new features without disrupting business operations. For instance, we implement multi-dimensional filters and customizable dashboards to existing data streams and embed economic and math functions (e.g., risk modeling, forecasting), letting users uncover trends without overhauling backend systems.

Backend Overhaul with Legacy Compatibility. Some applications require backend replacement due to security vulnerabilities or lack of scalability. Instead of a complete rewrite, we can create an adaptable middleware layer or implement a hybrid approach that allows new components to coexist with the old system, ensuring a smooth transition. Our backend overhaul approach also incorporates future-proof agility. API-friendly design ensures that new components not only coexist with legacy systems but are also adaptable to evolving market conditions and user requirements. This means that as your business grows and technologies change, your system remains relevant without incurring the high costs of redevelopment.

Read Also: From Old to Gold: Transforming Legacy Systems with Modernization Techniques (with Real Examples)

Once the goals and approach for modernization are defined, the next step is to develop a comprehensive strategy and select the right technology stack.

Crafting a detailed modernization strategy involves defining required steps and resources. It means the team needs to determine the key phases of the modernization process:

- Phases & Resources. Break down the modernization process into clear stages, identifying the necessary tools, infrastructure, and team expertise for each step.

- Timelines & Milestones. Establish realistic deadlines for each phase to ensure smooth progress while aligning with business priorities.

- Budget Planning. Allocate funds efficiently, balancing cost-effectiveness with high-quality implementation.

- Risk Management. Proactively identify potential challenges (e.g., data migration risks, integration hurdles, or security vulnerabilities) and define mitigation strategies.

Choosing the right tech stack is critical for performance, scalability, and security in financial applications. While this topic warrants an in-depth discussion, here are our key recommendations to guide your selection:

Core Infrastructure

| Component | Legacy Tech | Modern Tech | Why It Matters |

| Cloud Platform | On-premises servers |

|

Provides elastic scaling, high availability, and cost efficiency |

| APIs |

|

|

Facilitates faster and more flexible integrations with fintech and third-party services |

| Database |

|

|

Offers real-time analytics capabilities and reduces licensing costs |

Development Frameworks

| Layer | Legacy Tech | Modern Tech | Best For |

| Frontend |

|

ReactJS | Developing cross-platform applications with enhanced user experiences |

| Rapid development of complex financial interfaces using pre-built components (data grids, interactive charts, dynamic forms, scheduling), real-time data updates | |||

| Backend |

|

Efficient handling of high-speed transaction processing | |

| AI/ML | Rule-based |

|

Implementing advanced fraud detection and predictive analytics |

Modernization is not just about deploying new systems. It requires careful execution, continuous monitoring, and iterative improvements to ensure success. A well-planned implementation should follow a phased approach to minimize disruptions and maintain business continuity:

- Incremental Rollout. Instead of replacing entire systems at once, gradually modernize different components to reduce risks and ensure seamless transitions;

- Data Migration and Integration. We transfer legacy data securely while maintaining consistency. It helps ensure the new system integrates smoothly with existing tools and third-party services;

- Testing and Quality Assurance. Our quality assurance team conducts extensive testing (e.g., unit, integration, performance, and security testing) to identify and fix issues before full deployment.

Modernizing a financial system is not a one-time effort. It requires continuous maintenance and optimization to remain efficient, secure, and aligned with evolving business needs. A structured approach to ongoing improvements ensures long-term success and maximizes ROI.

Regular system upkeep prevents performance issues and security vulnerabilities. Key activities include:

- Routine Updates and Patches. Apply security patches, software updates, and framework upgrades to protect against emerging threats;

- Performance Monitoring. Real-time monitoring tools help track system health, detect slowdowns, and prevent outages;

- Bug Fixes and Troubleshooting. We timely address user-reported issues to maintain system reliability.

Conclusions

Modernizing financial systems is essential for staying competitive, secure, and efficient. A structured approach implies assessing the current system, defining goals, selecting the right technology, keeping and continuous optimization in mind. As seen in our CRM modernization use case, leveraging technologies like Node.js, React, Webix, and DHTMLX accelerates the process while improving performance and user experience. However, modernization isn’t just about technology. It also requires proper planning, staff training, and strategic execution.

If you’re looking to modernize your financial system, our team can help you develop a tailored strategy that meets your business needs. Feel free to contact us to discuss your project.