Previously in our blog, we dug into the Startup Universe and showed how it can be difficult for startups to grow. We also offered interesting solutions that many of our partners used to rise at the top, but this is not all that an IT outsourcing company can do to help a startup owner.

Today, we want to talk about the startup funding stages, analyzing each step, and explain how we, as an IT outsourcing company, can assist your startup. Therefore, let’s dive even deeper and know the secrets of the universe that can be found easier than one thinks.

What Each Stage Entails

Imagine you’ve got this killer idea that is going to change the world, or at least make it a bit cooler. But unless you have found a pot of gold at the end of a rainbow, you are going to need some cash to turn that brainwave into a booming business. That is where funding stages come into play, and oh boy, it is a journey!

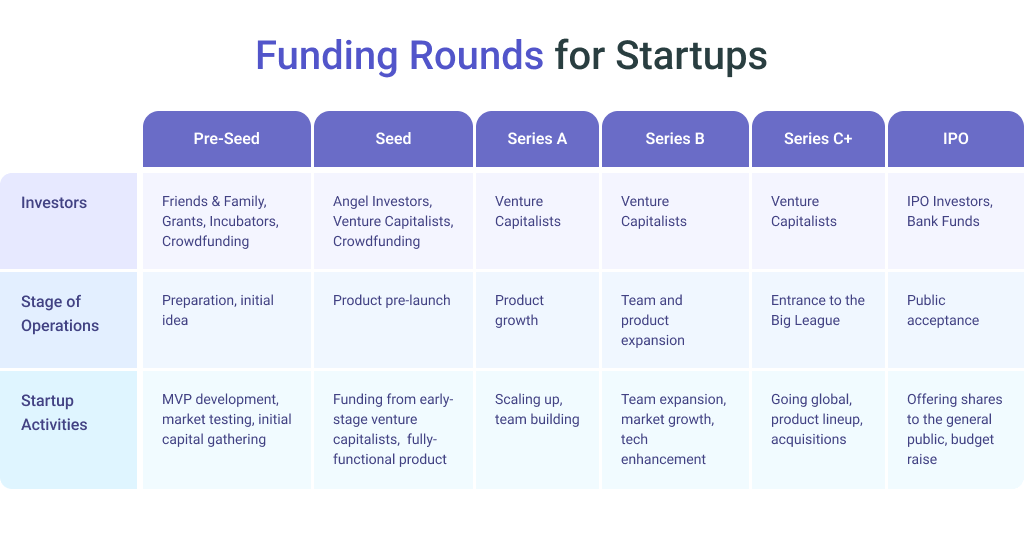

Each stage represents a level of maturity of the company and typically involves raising larger amounts of money as your startup progresses. Therefore, let’s take a closer look at each of these stages and analyze them in order to show you which services for startups an IT outsourcing company can offer to help you to grow and bloom.

Pre-Seed Funding: The “Just Getting Started” Stage

So, you’ve got an idea. It’s fresh, it’s exciting, and you are convinced that it’s going to be the next big thing. Great! But ideas need to be nurtured like tiny seedlings in your startup garden.

You can think of the Pre-seed funding stage as the water and sunshine for your seedling. Pre-seeding funds are usually not the big money that you will see in later rounds. The funds you gather during this stage can be enough to build a prototype or even MVP (Minimum Viable Product), do some market testing, and prepare for building a founding team at the next step. The primary objective is to find initial capital for all these activities so that you will be able to transform your concept into something bigger later. Of course, if you have sufficient resources, you can skip this stage, build an MVP, and start right with the seed funding stage.

Seed Funding: The “Hey, This Might Actually Work” Stage

Once you have something that resembles a business plan and a beta version of your product, you will be ready to fuel up the rocket ship for next phases. Therefore, at this stage, you need to decide what you are ready to show by now: a prototype or even an MVP. It all depends on what your team was capable of at the previous step. The key goal for this stage is to seek funding from early-stage venture capitalists and develop a fully-functional product ready for the market. Therefore, you need to have a business strategy for your product and have something more real to show off than just an idea during the startup pitching events. Otherwise, how would venture capitalists be able to choose you among others?

This is the time for you to find someone besides your friends and family who will be eager to provide support for your product. Therefore, make sure you have at least something to showcase them and be prepared to be as active as possible telling everybody “Hey, I’ve got this cool idea!”

But remember, with great funding comes great responsibility. Investors are looking for a return on their investment, so it’s time to hustle hard, make smart moves, and show them that their money is turning into more money.

Series A Funding: The “Time to Grow Up” Stage

According to Fundz, less than 10% of companies that raise a seed round are successful in then raising a Series A investment. It is typically the first significant round of the startup financing. So, if you have made it to the Series A funding stage, give yourself a pat on the back. It means that you are going to have a business that is more than just an expensive hobby.

All in all, Series A funding is all about growth. Startups that achieved some user traction enter this stage. Venture capitalists (VCs) become your new best friends with very specific expectations written in a contract, so you’ll know that it’s definitely getting serious. Now, you need to look for scaling up, expanding your team, and maybe even obtaining a real office. You need to understand that they are not just throwing money into a wishing well.

Series B Funding: The “Let’s Get Serious” Stage

If you hear someone from your team screaming “Houston, we need a bigger rocket!”, the time has come. Your startup approached the Series B funding stage.

Series B is like the teenage years of your startup. You are growing fast, and it’s kind of awkward and exciting all at once. You have proven that you are not a one-hit-wonder, and now you need money to expand, maybe go international, and start thinking about how your product is going to take over the world.

At this point, your startup is no longer a cool idea you had at the beginning, this is now a product that is making money, and you need to grab the wheel with both hands. So, now the focus should be on business development and market expansion:

- Expand your team even more. Hire more developers, marketers, and salespeople to turn up the volume on your product.

- Grow your market. Take your product global, or at least national. It’s time to go where the fans are.

- Enhance your tech. Make your product slicker, faster, and even more addictive.

Series C Funding and Beyond: The “Big League” Stage

The plot thickens! By the time you hit Series C, you can say for sure that you are playing in the big league. At this phase, startups are looking to scale quickly and effectively, which means it’s time for scaling operations, entering new markets, and acquisitions. Not all companies reach this stage, so be proud of yourself and your team!

Now, investors are throwing in huge amounts of money, and they are expecting the returns of the same size at least. They are investing in a world tour, a platinum record – they want to see you become the legend you are destined to be.

All in all, the Series C funding stage is about scaling up and growing so fast that you are practically breaking the sound barrier:

- Going global. Think world tour, but for your product. Your team is ready to take on new markets and make fans out of folks who don’t even speak your language.

- Product lineup. Just like dropping a new album or a hit single, it is your time to launch new products or features that will have your customers queuing up around the block.

- Acquisitions. Sometimes, the best way to make a splash is to bring other cool startups into your band. Acquisitions can help you diversify your ‘sound’ and reach even more fans.

IPO: The “Welcome to the Stock Market” Stage

And then comes the grand finale: the Initial Public Offering (IPO). At this stage, you get to ring the bell at the stock exchange and watch as your company’s name gets plastered on a big, shiny board. It is a way to raise a ton of money and let the public get a piece of the action. But remember that with the great power and great responsibility that you already have a lot of paperwork comes to the stage, so maybe you will need some data management and data visualization systems at your disposal to automate the process.

Now is when a company goes public and shares are offered to the general public on the stock market. This is a good way to raise a significant amount of budget to continue to achieve your growth objectives. Although, it comes with increased regulatory scrutiny and public expectations.

Read Also Product Roadmaps for Startup and Enterprise: Taking Up a Rocky Road or Turning Around?

Why Should a Startup Follow These Funding Stages?

Startup funding stages act as a roadmap for founders, offering several advantages:

- Matched Funding to Needs. Each stage provides capital aligned with the specific growth phase of the startup. Seed funding helps to validate ideas, while Series A focuses on scaling a proven concept. This avoids raising too much capital upfront or struggling with limited funds at critical junctures.

- Staged Risk Management. Investors in each stage have a risk tolerance suited to the maturity of the startup. Angel investors are comfortable with high-risk, early-stage ideas, while VCs seek established businesses with growth potential. This reduces the overall risk for founders.

- Validation and Credibility. Successfully securing funding at each stage validates the startup’s progress and potential. This attracts better talent, strengthens partnerships, and increases overall credibility in the market.

- Investor Expertise. Investors often bring not just money, but also valuable guidance and connections. Early investors might offer mentorship, while VCs can provide strategic advice and industry contacts.

- Structured Growth. The funding stages create a framework for growth. Each stage has specific goals, prompting founders to focus on achieving clear milestones before seeking further investment.

Of course, there’s flexibility. Some startups might bootstrap or take alternative funding routes. But following these stages offers a proven approach to secure capital efficiently, manage risk, and achieve sustainable growth.

How Can an IT Outsourcing Company Help?

An IT outsourcing team has the skills you may lack, you have the vision they can make real, so together it is possible to whip up a digital masterpiece that will impress the early users without breaking the bank. Your IT outsourcing partner can ensure that your tech is dressed to impress, with security, scalability, and performance all tuned to perfection. They are able to offer ongoing support and maintenance services to ensure that all the systems run smoothly. This includes troubleshooting, technical support, and regular maintenance tasks.

To dig deeper in the details of how exactly an IT outsourcing company can assist, we will share our solutions to have a better understanding:

- Market analysis. At the early stages, we can help you to analyze the market you are in, research its changes and innovations and suggest features that will fit your product and goals. Also, our experienced business analytics can help you in creating a better vision and scope to prepare for building a prototype.

- Visualize idea. As an IT outsourcing company, we can help you to get a better idea of how to make your product usable. We can develop a clickable prototype so both you and your investors will understand your idea. A prototype lets you see if the idea actually has the chance to work.

- Develop a demo version of a product. Seeing how beautiful your product can be is one thing, but testing it in the real environment is the whole other matter. Therefore, we can create a demo product using Webix JavaScript UI library to spend less time. Maybe, some of the features will turn out to be irrelevant or difficult to use, so it will be easier for you to know where to go further. You can also use your demo or prototype to gather early user feedback and see if this is what the market wants and expects.

Read Also The Intricate Art of Maximizing Value. How To Make Every Coin Spent Worth its Weight In Gold

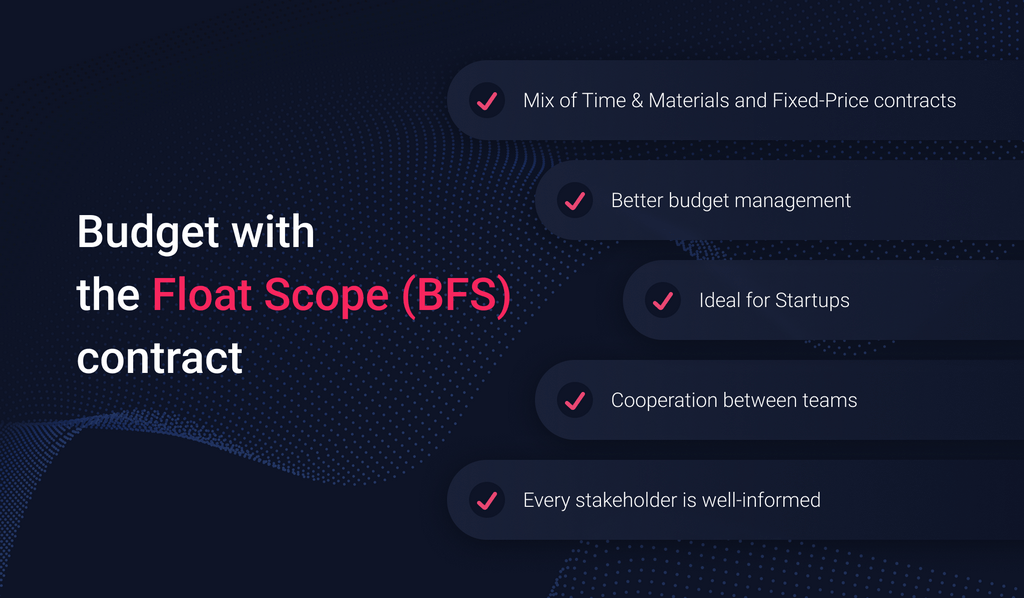

- Develop an MVP. When working with our company, we can work under the Budget with Float Scope (BFS) contract type and offer you the development of an MVP. Often, startup owners want to implement all the possible features into their idea to make the best product in the world. We understand the desire, however, it is important to act consistently. Thus, our BFS contract model offers to spend money on those features that really matter and leave the resources for further steps.

- Creating software that will help you in the process. In the process of product market scalability, we can assist you in developing new cutting-edge features or integrating complex technologies and make the product meet the requirements of the market. Besides helping you with your key product, we can assist you in creating project management software, data visualization systems, CRM solutions, or other tools that will be useful for your business.

- Staff augmentation. If you don’t need an entire outsourcing team with its own specialists, we can also offer you to increase your team with a dedicated team of developers that have the tech skills your product requires, letting your team handle all other tasks.

The funding stages aren’t a rigid rulebook. Some startups choose to bootstrap their way to success, relying on their own resources and revenue. Others might explore crowdfunding platforms or debt financing. The key is to find the approach that best suits your company’s needs and risk tolerance. And our task in all of this is to be your loyal partner and see you growing.

Conclusions

Throughout different startup funding stages, an IT outsourcing company is able to help your indie company become a thriving business that is on everybody’s lips. You will be able to keep costs down while having access to top-notch tech talents. An IT outsourcing company is like a Swiss Army knife for startups – whether you need to carve out a niche or unscrew a tricky problem, they have the required tool for the job. And, as a result, you can become a global sensation. So, if you, as a startup owner, need any help, please contact us, and our team will be glad to bring your ideas to life.