Summary

Spreadsheets are risky for financial compliance because they’re prone to errors and lack proper controls like input validation and regulatory checks. Custom platforms, on the other hand, ensure data accuracy, automate workflows, and help businesses stay compliant with evolving financial regulations. This makes them a far more reliable solution for finance teams.

Spreadsheets have long served as the foundation of the financial sector, supporting everything from client tracking to compliance monitoring across both small advisory firms and large wealth management companies. However, as the industry evolves with stricter regulations, expanding teams, and a growing need for real-time collaboration, the limitations of relying solely on spreadsheets are becoming evident. This article examines why many financial institutions are moving away from spreadsheets and how custom software for managing finances enables smarter, more secure, and scalable operations.

When Spreadsheets Work

Spreadsheets offer a degree of ease of use. For small finance firms or one-off projects, creating a sheet is faster than installing and configuring complex software. Also, there’s interface familiarity. Most finance professionals are comfortable with a spreadsheet’s basic functions, such as calculations and filtering. It lowers the initial learning curve for simple, noncustodial uses like tracking specific metrics internally without strict compliance overhead.

Spreadsheets are great for quick calculations, generating simple reports, and rapidly prototyping ideas. However, these benefits quickly fade when you consider the realities of a modern financial practice. The inherent limitations of spreadsheets, such as lack of true collaboration, poor data validation, and difficulty in scaling, often lead to significant operational inefficiencies and increased risk.

Top 5 Problems Finance Firms Have with Spreadsheet Dependency

No Real-Time Collaboration & Version Control Chaos

In wealth management firms, compliance teams, financial advisors, and operations staff often share spreadsheets via email or cloud links (like Google Sheets), leading to multiple versions floating around. Multiple users attempting to access and update the same spreadsheet simultaneously leads to version control nightmares, conflicting data, and ultimately, miscommunication. Financial advisors and back-office teams might work offline for days before syncing back to the “master,” creating delays and potential data divergence between team members’ local files and central repositories.

Practical Example. While reviewing a high-net-worth client’s investment profile, the advisor is using a spreadsheet updated last Friday, while the compliance officer is reviewing a Monday version. When questioned by the regulator, they can’t even agree on the client’s most recent asset allocation.

Poor Data Validation & Inherent Human Error Magnets

In finance, one mistyped figure can mean reporting a client’s net worth incorrectly, triggering compliance violations or eroding client trust. Spreadsheets lack the controls needed for regulatory data entry. Unlike financial management software, spreadsheets have no input restrictions, no field dependencies, and no real-time validation against financial regulations (such as KYC or AML checks). Typos, incorrect formulas, and inconsistent data entry are rampant, leading to inaccurate reporting and flawed decision-making. Complex validation logic for financial inputs, like ensuring specific account numbers exist in the system (e.g., checking IRS filing status codes against pre-approved values) or verifying that all client contact fields align with specific requirements, rely on manual checks, prone to mistakes.

Practical Example. A compliance audit finds clients whose data doesn’t meet FINRA 4511 criteria because it wasn’t systematically validated.

Nightmare for Compliance & Audit-Ready Data

Regulatory compliance in the finance industry is intensely scrutinized. The lack of audit trails makes FINRA and SEC compliance incredibly difficult for Chief Compliance Officers (CCOs). Unlike spreadsheets, dedicated compliance and audit tracking software auto-generates FINRA-ready logs, from email consent trails to trade reconciliation timestamps.

Practical Example. When a regulator requests proof of client consent for data sharing, your team digs through dozens of shared folders with no centralized history.

Can’t Scale Across Departments & Complex Workflows

As your firm grows, spreadsheets quickly become a bottleneck. Managing increasing volumes of data and supporting financial advisors, compliance officers, and client onboarding specialists becomes exponentially more challenging. Also, siloed functionality in separate spreadsheets fragments the client view.

Practical Example: An advisor needs a client’s full financial picture (retirement, investments, insurance) from different departments to make one recommendation or report. Spreadsheets mean pulling data manually across multiple silos.

Limited Automation & Reporting Capabilities

Generating complex reports for compliance filings or high-level strategic insights becomes time-consuming and resource-intensive. Whether it’s calculating performance-based fees, submitting SEC Form ADV updates, or generating portfolio summaries for clients, spreadsheets buckle under complex financial reporting.

Practical Example. Calculating performance fees based on multiple tiers, hurdle rates, and specific client classifications requires intricate formulas in Excel that are slow to recalculate, prone to error, and hard to explain consistently.

Read Also: The Game-Changing Role of App Modernization in the Finance Industry

Why Finance Firms Are Moving to Custom Platforms

Structured Workflows & Role-Based Access Control (RBAC)

When advisors, assistants, and marketing coordinators access client data via the same spreadsheet, there’s no control over who could view or modify sensitive data. For wealth management and asset management software systems handling portfolio tracking and client onboarding, role-based access ensures advisors only see their assigned clients while preserving a holistic firm-wide view.

Custom software for finance integrates compliance-driven permissions. It allows defining roles like “Master Admin”, “Account Owner”, “Standard User”, or “Limited User”, depending on requirements. These roles have specific data access rights aligned with regulations or internal policies.

Client Value. Software solutions that support RBAC improve collaboration and minimize risks associated with insider threats. Role-based access ensures only authorized personnel can view sensitive client information. It invests in protecting PII (Personally Identifiable Information), and guarantees compliance-ready permission structures.

Real-Time Data Streaming & Alerts for Market Movements

For financial firms offering portfolio advice or FX (Foreign Exchange) exposure planning, spreadsheet-delivered pricing data is often delayed, introducing trade risk. Manual exports from sources like Refinitiv or banking portals mean rates are minutes (or hours) old. A 2% EUR/USD swing might go unnoticed until a portfolio manager manually refreshes the sheet.

Custom finance software development services can establish live market data pipelines through direct API integrations, streaming currency rates or other data with sub-second latency. This eliminates the need for manual refreshes, as all data automatically updates across dashboards and client reports in real time. For critical market movements, such a platform can implement threshold-based alerts that monitor custom parameters like USD/JPY moving by 1.5% within a 15-minute window.

Read Also How to Build an Excel Add-in With React

Client Value. Firms that use custom software for managing finances can receive market updates instantly, ensuring that recommendations are based on live data, not stale exports.

Real-life example. In our work with an online brokerage facing critical trading limitations, we developed a real-time Rate Management System that transformed their operations. The client struggled with delayed market data that was often 15-30 minutes stale, forcing traders to make decisions with outdated information during crucial market movements. Their analysts wasted 2-3 hours daily manually compiling technical indicators across separate spreadsheets for FX, equities and derivatives.

We implemented a custom software solution delivering millisecond-latency data through WebSocket connections to reliable liquidity providers The system featured advanced charting with 15+ visualization types like Candlestick and OHLC, along with custom technical indicators and a smart alert engine monitoring 200+ market conditions.

Built-in Analytics & Automation

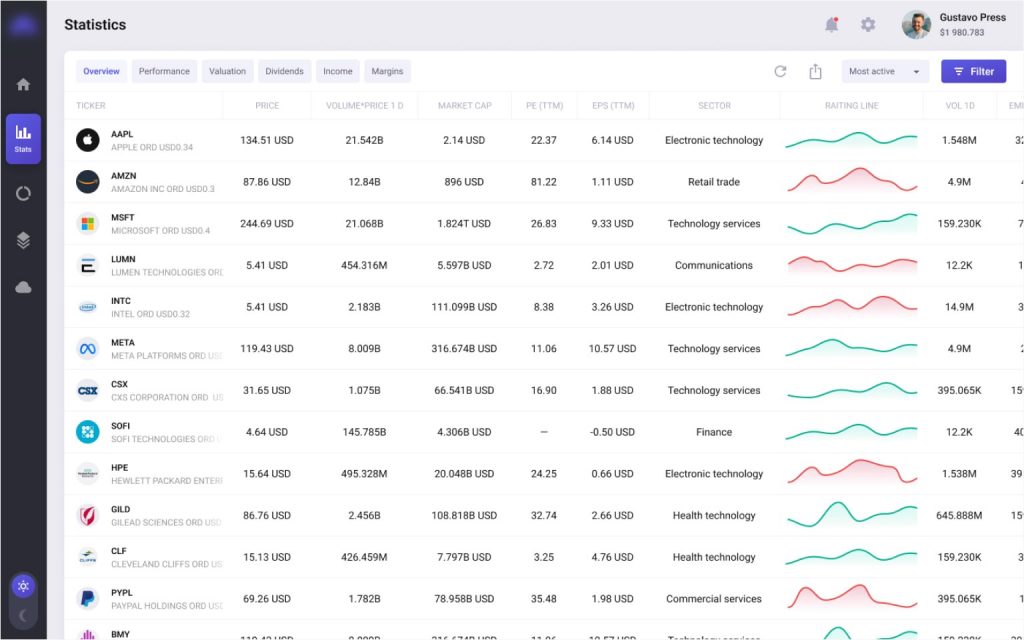

With spreadsheets, building performance reports requires pulling data from various sheets and formatting them manually for every client. A custom-made solution provides access to data visualizations and powerful built-in analytics for trading data or financial planning insights. These are essential features for modern software for managing finances in regulated environments

Client Value. Financial analysts can use custom finance software to generate compelling reports with a few clicks. It frees up valuable time from manual report creation, allowing advisors to focus on client value rather than data wrangling.

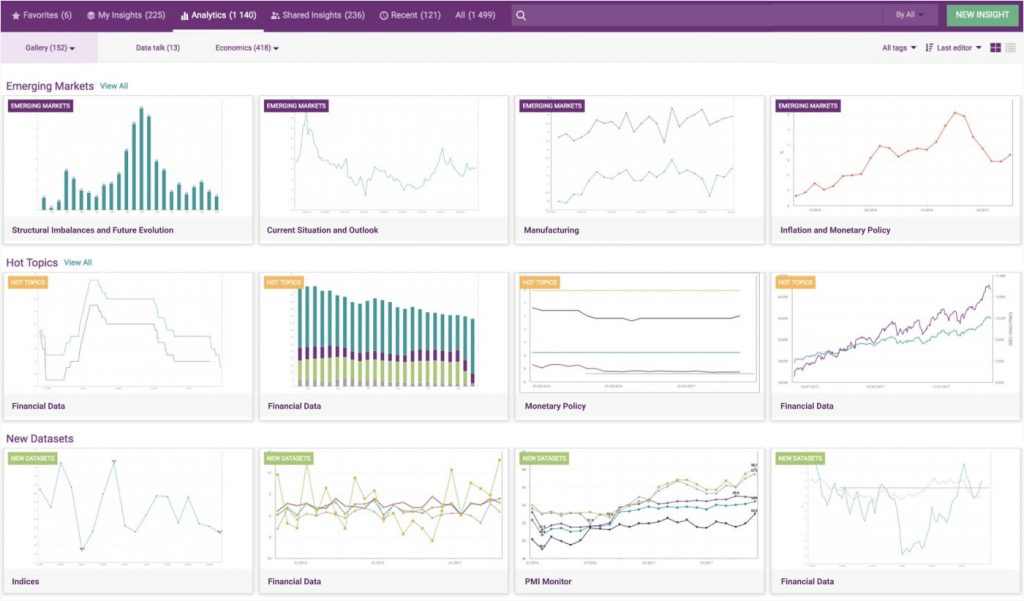

Real-life Example. When a financial analytics firm found itself drowning in 4 million+ economic data points from 1,500 sources, their legacy software was creating more confusion than clarity. Analysts wasted hours manually cross-referencing spreadsheets, while outdated visualization tools failed to reveal critical macroeconomic trends hidden in their growing datasets.

Our team developed an Economic Research Tool that combines Webix UI widgets and Highcharts for instant visualization of indicators like GDP, inflation, and currency rates across 15+ formats, from heatmaps to histograms. A smart search system understands mnemonic codes (e.g., “CN.GDP.*” for all China GDP metrics) and suggests relevant datasets as users type. Analysts can drag-and-drop data between discovery, analysis, and visualization modules, applying real-time currency conversions or advanced functions with clicks rather than code. What previously took hours of spreadsheet manipulation, happens in minutes with the new finance software. Users generate publication-ready charts, create custom forecasts using built-in econometric models, and share insights via collaborative dashboards.

Seamless Integration & Data Integrity

Client data may sometimes be entered multiple times across spreadsheets with conflicting contact info, resulting in missed communications and duplicate follow-ups. Another possible issue are deleted contacts that remain in linked sheets, causing reporting errors and skewed analytics.

Adopting new custom financial software can help break data silos by connecting directly with solutions that store your existing client records. Therefore, you can start using a unified platform for all interactions. Custom systems can ensure that when a contact is removed, it’s automatically excluded from dashboards, filters, and reports. For example, retirement planning tools for 401(k)s or IRAs benefit from unified data, automatically syncing income modeling assumptions across client dashboards and advisor workflows. Automated dependency management system triggers when a contact is updated. For instance, it can check for relationships (e.g., spouses, shared accounts) and flagged dependencies before finalizing actions.

Client Value. Custom software ensures that critical data points, like client classifications or specific financial product details (e.g., retirement plan assumptions), are consistently captured and linked across relevant views. It prevents bad data from polluting high-stakes reporting, a must for client-facing financial professionals.

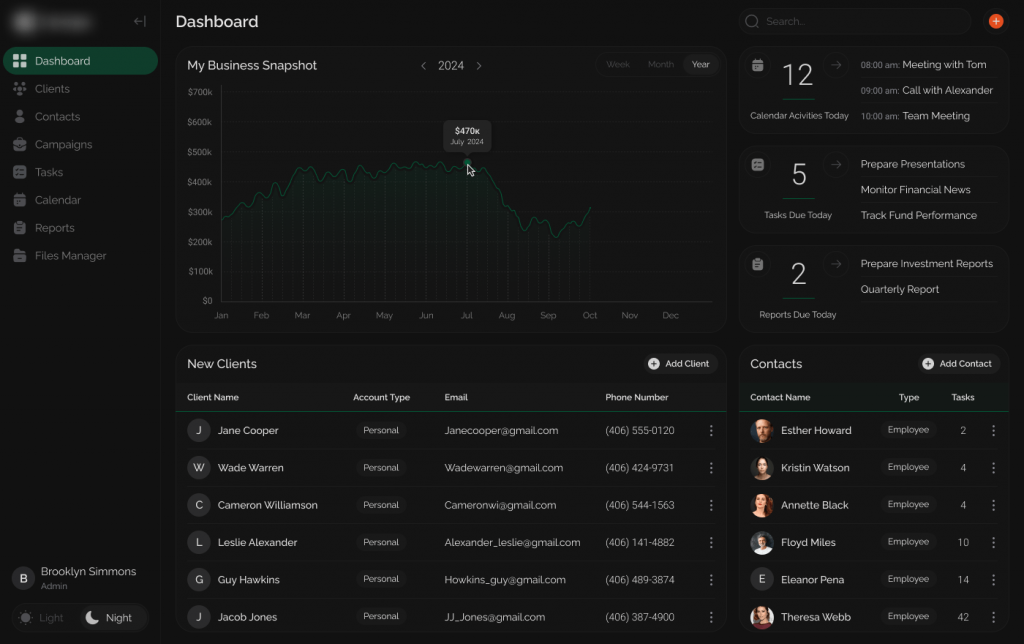

Real-life Example. A financial company had a legacy system forced advisors to spend many hours weekly on manual data entry, resulting in error rates exceeding 12% across client records, while siloed data required constant switching between five different spreadsheets just to complete basic tasks. This fragmentation created significant delays in responding to client requests.

Our team modernized Financial CRM Software and preserved 90% of our client’s historical data while eliminating inconsistent database structures. This wealth management CRM automates client suitability checks and fiduciary reporting obligations. Also, The new platform unified email systems, portfolio tools, and support channels into a single dashboard, reducing workflow.

Audit Trails & Compliance Management

Custom finance software development allows implementing automated processes for critical compliance functions like expense management (ensuring proper client consent), CRM data tracking, and portfolio performance monitoring. For instance, managing the 90-day data retention window involves automatic deletion of unsensitive or inactive data after a defined period, with clear logs for compliance teams to review. They can also track all client communication templates used in emails (for FINRA 4511) and associate them directly with specific client communications via message IDs or email tracking.

Client Value. Custom software for finance firms supports compliance with data sovereignty laws, simplifies audit trails, and mitigates liability by enforcing structured data governance.

Future-Proof Your Firm: Ditch Spreadsheet Chaos for Compliance & Growth

Spreadsheets had their moment, but for today’s financial firms, clinging to them is like navigating a regulatory minefield with an outdated map. The shift to custom software for managing finances is about securing scalability, slashing risk, and unlocking time to focus on clients. It enables collaboration without chaos, growth without bottlenecks, and makes your data audit-ready at a click.

Contact us today to leverage our finance software development services and transform your operations with a platform built for compliance, efficiency, and client trust.